Beware of Mis-Selling: A Real Investor Story with Money Back Insurance Policies

- Abraham Cherian

- Nov 29, 2025

- 9 min read

Updated: Dec 12, 2025

A retired investor narrowly escaped being mis-sold a money back insurance policy by a manager at one of India's largest public sector banks. The experience offers crucial lessons for every investor about recognizing aggressive sales tactics, understanding product features, and asking the right questions before committing large sums to financial products.

The Incident: How a Bank Manager Blocked a Legitimate Investment

The situation unfolded during a straightforward transaction. An investor had decided to invest a substantial sum (over 2 crores) directly into a carefully selected mutual fund portfolio. To facilitate this investment, he needed to initiate an RTGS (Real Time Gross Settlement) transfer at his bank branch—a routine banking procedure.

However, when the branch manager learned that the money was intended for an advised mutual fund investment, he did something questionable. He delayed the transaction, citing vague excuses about "limitations outside home branch" and other unclear restrictions. More problematically, he then attempted to redirect the investor toward a different product entirely.

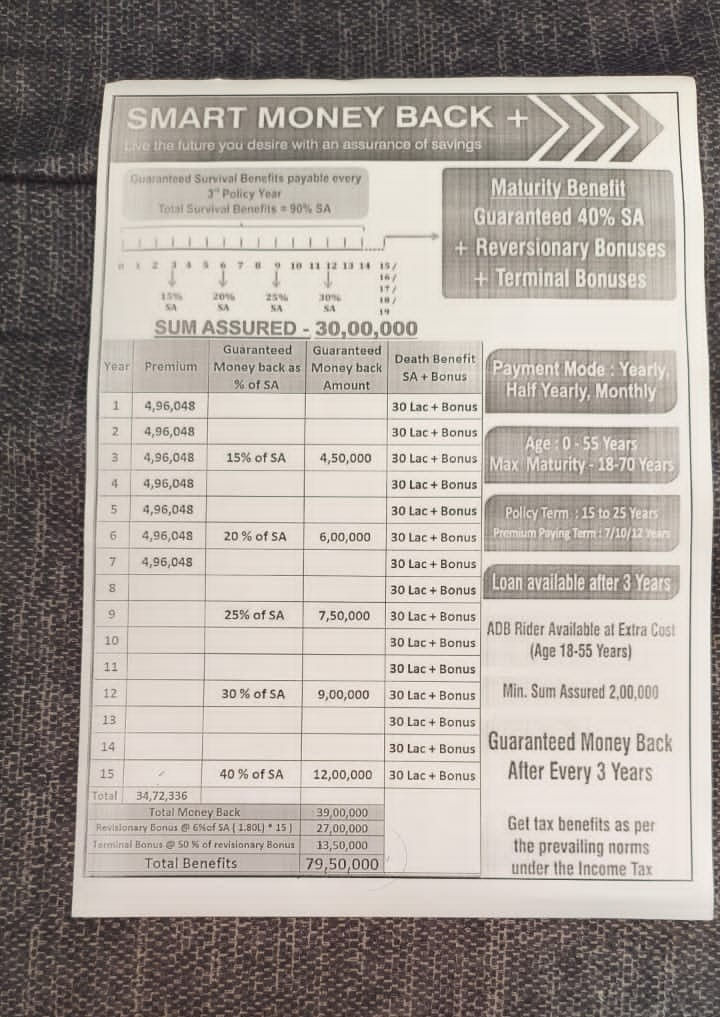

The manager questioned the investor: "Why can't you invest on your own? Why are you paying an advisor? We will help you with a better product." He then handed over a sheet of paper—with no official letterhead, no contact details, and no ownership of the claims made—promoting a classic money back insurance policy.

This incident is not an outlier. The Reserve Bank of India and insurance regulators have repeatedly raised concerns about banks pushing insurance products through high-pressure sales tactics. Public sector bank employees often face immense pressure from senior management to meet insurance sales targets, creating a conflict of interest between serving customer needs and meeting internal incentives.

Understanding Money Back Insurance Policies: Features and Flaws

A money back policy is a traditional life insurance plan that blends insurance coverage with periodic survival benefits paid during the policy term, along with a lump sum at maturity. On the surface, this combination might sound appealing, but a deeper examination reveals several significant drawbacks.

Key Features of Money Back Policies

Periodic Survival Benefits: The policyholder receives a portion of the sum assured at regular intervals (often every 5 years), providing interim payouts throughout the policy term.

Death Benefit: If the policyholder dies during the term, the nominee receives the full sum assured regardless of survival benefits already paid.

Guaranteed Returns: These policies promise fixed, guaranteed returns with no market risk.

Maturity Benefit: At the end of the policy term, the policyholder receives the remaining sum assured plus any accumulated bonuses.

Tax Benefits: Premiums qualify for tax deduction under Section 80C of the Income Tax Act, and maturity benefits are typically tax-free under Section 10(10D).

Why These Features Can Be Detrimental to Investors

1. Significantly Lower Returns

The most critical drawback of money back policies is their poor return profile. Because a substantial portion of premiums is allocated toward providing survival benefits and maintaining insurance coverage, the amount available for actual investment is limited. Money back policies typically deliver only 4-5% annualized returns, which falls far short of inflation in India.

When inflation averages 5-7% annually (as it has in recent years), a 4-5% return means your purchasing power is effectively eroding. In real terms, you're losing money. An investor investing ₹5 lakh in such a policy earning 5% annually while facing 6% inflation is experiencing negative real returns of approximately 1% per year.

2. Long Lock-In Periods Restrict Liquidity

Most money back policies come with a mandatory 5-year lock-in period. During this time, you cannot access your money without facing significant penalties. In contrast, mutual funds allow you to redeem your investment almost any time.

This lack of liquidity can be problematic in emergencies or if your financial priorities shift. The penalty for early withdrawal can be severe, sometimes consuming years of accumulated returns.

3. Insurance Coverage You May Not Need

For retired individuals or those with minimal financial dependents, life insurance coverage is often unnecessary. Yet money back policies bundle insurance with investment, forcing you to pay for protection you don't require. This increases your premium costs without adding value to your specific situation.

4. High Premiums and Hidden Costs

Money back policies charge substantially higher premiums compared to pure term insurance or investment-only vehicles like mutual funds. A portion of what you pay goes toward:

Insurance administration

Survivorship benefit mechanisms

Agent commissions (which can be as high as 80% of the first-year premium under current IRDAI guidelines for traditional plans)

Fund management fees

These layered costs significantly reduce the portion of your money actually working toward growth.

5. Failure to Keep Pace with Inflation

Fixed payouts from money back policies don't adjust for inflation. Money received after 5 years, 10 years, or at maturity will have substantially less purchasing power than expected if inflation rises. This is particularly problematic for retirees planning for long-term financial security.

6. Lack of Diversification and Flexibility

When you invest in a money back policy, your capital is locked into a single, rigid product structure. You cannot rebalance, adjust asset allocation, or pivot your strategy based on changing market conditions or personal circumstances. Mutual funds, by contrast, offer numerous options with varying risk-return profiles.

Why Conservative Direct Mutual Funds and even Debt Funds Outperform Money Back Policies

For most investors, especially those with a 5-year horizon, direct mutual funds—particularly conservative hybrid and debt fund options—offer significantly superior returns compared to money back policies.

Return Comparison

Conservative hybrid funds have delivered approximately 8.5% annualized returns over 5 years, with 3-year and 10-year returns around 8.88% and 7.76% respectively. Even pure debt mutual funds consistently outperform the 4-5% offered by money back policies.

Comparing a ₹5 lakh investment over 5 years:

Money Back Policy (4% return): ₹6.08 lakh

Conservative Hybrid Fund (8.5% return): ₹7.43 lakh

Difference in wealth creation: ₹1.35 lakh additional gain (22% more)

This gap becomes even more pronounced when inflation is factored in. After accounting for 6% inflation, the money back policy provides virtually no real return, while the hybrid fund still delivers meaningful wealth growth.

Liquidity and Flexibility

Direct mutual funds offer complete liquidity. You can redeem your investment whenever needed without penalties (except for ELSS funds with a 3-year lock-in). This flexibility is invaluable during financial emergencies or when opportunities arise.

Lower Costs with Direct Plans

By investing in direct mutual funds (not through regular/distributor plans), you eliminate intermediary commissions entirely. Direct plans charge lower expense ratios, typically 0.5-1% annually compared to 1.5-2.5% for regular plans. Over a 5-year period, this cost advantage significantly enhances your returns.

No Unnecessary Insurance Component

If you need insurance, you should buy term insurance—the purest form of life cover. A ₹1 crore term insurance policy can cost as little as ₹15,000-25,000 annually for a healthy 50-year-old. There's no justification for bundling protection you don't need with your investments.

Keep insurance and investments separate. This clarity makes it easier to evaluate each product on its own merits and ensures you're not overpaying for unwanted coverage.

Critical Questions to Ask When an Agent Offers Insurance with "Assured Returns"

When any agent or bank manager tries to sell you a money back policy, ULIP, or any other insurance product promising assured returns, demand written answers via official email to these five essential questions:

1. What is the XIRR (Annualized Internal Rate of Return)?

Why this matters: XIRR accounts for the timing of cash flows and provides a true annualized return that's comparable to other investments like mutual funds. Many agents quote returns using deceptive methods (like simple multiplication) that overstate actual performance.

When shown a benefit illustration, always calculate XIRR yourself using the insurance policy return calculator. If an agent cannot provide or explain XIRR, this is a red flag indicating they either don't understand the product or are deliberately obscuring its true return.

2. What is the Lock-In Period and Exactly When Can I Withdraw My Money?

Why this matters: Vague answers about lock-in periods are a warning sign. You need clarity on:

When you can first access your money

What happens if you need funds before the lock-in ends

The exact penalties or surrender value if you exit early

Request written confirmation of these terms from the agent or bank official, not just verbal assurance.

3. What is the Penalty or Surrender Charge for Premature Withdrawal?

Why this matters: Surrender penalties can be substantial, sometimes consuming 5-10 years of accumulated returns. For a ₹5 lakh premium policy, early withdrawal penalties might be ₹50,000-₹1,00,000 or more.

Insist on getting the exact penalty structure in writing for every potential withdrawal year: after 1 year, 2 years, 3 years, etc. This allows you to calculate the true cost of accessing your money if needed.

4. How Much Commission Will the Agent/Bank Earn in the First Year on My Investment?

Why this matters: Current IRDAI guidelines allow up to 80% commission on first-year premiums for traditional policies like money back plans. This massive incentive creates a powerful motivation for mis-selling.

For a ₹5 lakh premium, this could mean ₹4,00,000 in commissions to the agent or bank manager in year one—far more than they earn selling mutual funds. This explains the aggressive push.

Request the exact commission amount (not percentage), as it reveals the true incentive driving the sales pitch. Ask: "If I invest ₹5 lakh, how much commission do you personally earn in year one?"

Most agents will be uncomfortable answering directly, which tells you everything you need to know.

5. What is the Inflation-Adjusted Real Value of the Money I'll Receive at Maturity?

Why this matters: This question forces the agent to confront the devastating impact of inflation on guaranteed returns. Calculate what ₹1 lakh paid to you after 5 years is worth in today's money.

Example: If you're promised ₹1 lakh after 5 years with 5% average inflation:

Inflation-adjusted value = ₹1,00,000 / (1.05^5) = ₹78,353

In today's purchasing power, you're receiving only ₹78,353—a significant erosion of value. A direct mutual fund earning 8.5% would deliver approximately ₹1,25,000 in the same timeframe, which inflates to real value of around ₹98,000.

Why These Questions Matter

Asking these questions accomplishes several things:

It shifts the conversation from emotional selling to fact-based comparison. Agents selling on commission prefer vague benefit illustrations to clear, comparable metrics.

It creates a written record. When you request email responses, you have documentation if a dispute arises later.

It reveals conflicts of interest. When you learn an agent earns ₹4 lakh in commissions while the product delivers 4% returns, the misalignment with your interests becomes obvious.

It often stops the sales process. Many agents will become evasive when forced to provide specific, comparable numbers. This evasion itself is a warning sign.

Regulatory Context: The Problem of Mis-Selling in Banking

This incident with the investor reflects a systemic issue within Indian banking. The RBI and insurance regulators have documented widespread mis-selling of insurance products through bank branches.

Why does this happen?

Public sector bank managers and employees face intense pressure from senior management to meet insurance sales targets. Failure to meet targets invites informal penalties, while meeting them brings rewards including international trips and resort parties. This creates a perverse incentive structure where maximizing insurance sales becomes more important than serving customer needs.

Additionally, bank staff receive direct incentives from insurance companies—not just commission on sales, but bonuses, recognition programs, and career advancement tied to insurance sales performance. Some banks have been accused of even misusing customer data shared with insurance partners, allowing insurers to directly approach depositors.

In 2013, the RBI explicitly cautioned banks about these practices, noting insufficient segregation between banking and insurance sales functions. Yet the problem persists a decade later.

Recommendations for Every Investor

1. Separate Insurance from Investment Decisions

Buy pure term insurance for actual protection needs. Invest in mutual funds for wealth creation. Keep these decisions independent and transparent.

2. Always Insist on Written Documentation

When approached by a bank manager or agent, request all information in writing via official email. Verbal promises carry no weight if disputes arise later.

3. Use Comparison Tools

Calculate XIRR for any insurance product being offered. Compare it against simple alternatives like:

Direct debt mutual funds (8-9% returns)

Conservative hybrid funds (8.5% returns)

Fixed deposits (6-7% returns)

If an insurance product cannot beat these benchmarks, there's no rational reason to choose it.

4. Consult Independent Advisors

Consider seeking guidance from a SEBI-registered independent financial advisor who has no incentive to push commission-heavy products. The fee you pay is often far less than the commissions you'd lose to mis-sold insurance.

5. Understand Your Actual Insurance Needs

If you have dependents or outstanding liabilities, buy appropriate term insurance. A ₹1 crore 20-year term policy costs around ₹15,000-20,000 annually. If you don't need insurance, don't buy it bundled with your investments.

6. Exercise Your Rights as a Consumer

If you believe you've been mis-sold an insurance product, file a complaint with:

The insurer's grievance redressal department

The Insurance Ombudsman

The IRDAI directly

The RBI's banking ombudsman (if mis-sold through a bank)

Protect Your Money Through Informed Decision-Making

This investor's near-miss with a money back policy is a cautionary tale, but it's also an empowering one. When you understand the true mechanics of these products—their low returns, hidden costs, long lock-ins, and the massive commissions driving their sale—you're equipped to make decisions that actually serve your financial goals.

Money back policies have their place in specific situations, but they should never be sold to retired individuals with minimal insurance needs or to anyone seeking wealth creation. When someone pushes these products aggressively, especially without providing clear, comparable metrics, it's time to walk away.

Your financial security deserves better than products designed to maximize commissions at the expense of your returns. Direct mutual funds, combined with appropriate term insurance, offer a far superior approach for nearly all investors.

Ask the hard questions. Demand written answers. Compare the numbers. Your future self will thank you for the clarity and discipline you exercise today.

Disclaimer: This content is for informational purposes only and does not constitute financial or tax advice. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing.

https://www.policybazaar.com/lic-of-india/lic-vs-mutual-funds/

https://www.hdfclife.com/insurance-knowledge-centre/ulip-guide/ulip-vs-mutual-fund

https://primeinvestor.in/reports/what-is-the-return-on-your-insurance-policy/

https://joinditto.in/articles/life-insurance/money-back-insurance-policy/

https://www.tataaia.com/blogs/ulip/4g-ulip-vs-mutual-fund-where-should-you-invest.html

https://kaseinsurance.com/news/insurance-questions-for-broker/

https://www.whiteblacklegal.co.in/details/misselling-of-insurance-by-banks-by---prakriti-m

https://www.etmoney.com/mutual-funds/hybrid/conservative-hybrid/71

https://mf.nipponindiaim.com/knowledge-center/tools/inflation-calculator

https://www.moneycontrol.com/mutual-funds/performance-tracker/returns/conservative-hybrid-fund.html

https://www.bankbazaar.com/life-insurance/all-about-lic-agents-and-their-commissions.html

https://www.investt.in/calculators/insurance-return-calculator

Comments